Key Takeaways

- How much debt do you have?

- Debt-to-income ratio

- How to get out of debt

- Tools to get out of debt

Investing is the best way to build a passive income or save for retirement. But it’s difficult to invest when you’re saddled with debt. The higher your debt, the less money you’ll have to contribute toward investments.

Before you build the investment portfolio of your dreams, you first need to learn how to get out of debt. There are five ways you can work to eliminate your debt, no matter how much you have.

How Much Debt Do You Have?

Before you get started, you need to ask yourself a fundamental question: how much debt do you have?

Understanding how much debt you have is the first step to getting rid of it.

Tallying up your debt may be more difficult for some people than for others. Sometimes it’s difficult to own up to how much debt you have—it causes stress and worry. Ignoring your debt is much easier to do.

But here’s something that should make you feel better: according to a study in 2020, the average American is about $67,000 in debt. You’re not the only one struggling to get a handle on it.

With that in mind, begin to tally up all your major debt:

- Mortgage loans

- Auto loans

- Student loans

- Credit card debt (including store credit cards)

- Any other personal loans

You don’t have to include alimony or child support. These should be categorized as living expenses and not debt.

Figure out how much money you owe on each outstanding loan and figure out how much your payments are for each loan.

Once you’ve done that, you can calculate your debt-to-income ratio.

What is Your Debt-to-Income Ratio?

Your debt-to-income ratio (DTI) compares how much money you’re earning against how much debt you have.

You can calculate your debt-to-income ratio using your annual debt and income, or your monthly debt and income.

Annual Formula:

Your Annual Debt / Your Annual Income = Debt-to-Income Ratio

[ $20,000 / $50,000 = 0.4 ]

Monthly Formula:

You Monthly Debt / Your Monthly Income = Debt-to-Income Ratio

[ $1,200 / $3,000 = 0.4 ]

What’s considered a good DTI? These are the general benchmarks:

- Low DIT: 0.2 or less

- High DTI: 0.4 or higher

Most financial institutions consider a DTI of 0.4 or higher to be a sign of financial distress.

Why is Your Debt-to-Income Ratio Important?

If you earned $1 million per year, then a $20,000 debt probably wouldn’t be intimidating.

But if you only earned $40,000 per year, then a $20,000 debt would be far more stressful. That would be half of your income.

What matters isn’t necessarily the amount of debt you have but how it compares against your income. The debt-to-income ratio helps you put your debt into perspective.

As we describe the methods you can use to get out of debt, we’ll refer to DTI to gauge whether or not each method may be suitable for your financial situation.

How To Prepare to Get Out of Debt

Assemble the following information:

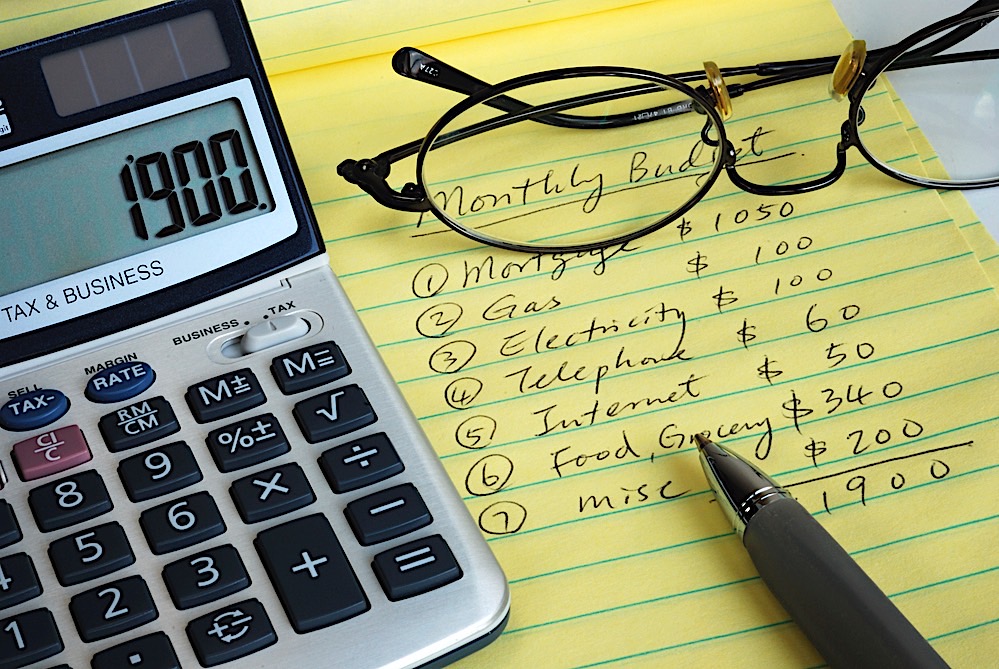

- Debts: Create a list of all your outstanding debt. Also, list your monthly payment amount for each loan and your interest for each loan.

- Expenses: Create a general list of all your monthly expenses: rent, utilities, food, etc. It’s most important to tally your “essential” living expenses, but also create a list of your recurring “fun” expenses, like subscriptions and membership fees.

This information will come in handy as you work to get out of debt.

How To Get Out of Debt in 5 Ways

There are five ways to get out of debt:

- Use a 50/30/20 Budget

- Earn More Than Your Base Income

- Make Extra Payments

- Refinance Your Debt

- Negotiate a Settlement

1. The 50/30/20 Budget

It’s always helpful to understand why you got into debt in the first place. Many people get into debt because they overspend on their credit cards or take out loans they can’t afford. Other people suffer a loss of income and suddenly aren’t able to pay back their debt.

Regardless of how you got into debt, you’re sure to benefit from a budget makeover. Budgeting is helpful for two reasons. First, a good budget will keep you from overspending so you have more money to pay down your debt and so you won’t acquire new debt. Second, a good budget will help you allocate a sufficient amount of money toward your debt without rendering you house poor.

The 50/30/20 budget is great for anyone who’s trying to get out of debt. Here’s how it breaks down:

- 50% of Budget: Essential expenses, like rent, utilities, and food.

- 30% of Budget: Wants, like new clothing, furniture, or “night out” spending.

- 20% of Budget: Paid toward debt.

First, you need to be able to cut your essential living expenses to 50%. If your living expenses are greater than 50% of your earnings, you might consider moving to a cheaper home or eating out less.

Second, you need to cut your “want” expenses to just 30% of your earnings. For some people, this might be easy to do. But for others, this may require a significant lifestyle change. You’re basically becoming a “minimalist.” That means you’re not going to spend very much money on things that aren’t essential to your well-being.

When you’re living a minimalist lifestyle, you probably won’t spend as much money on new furniture, clothing, or electronics. Instead, you’ll spend that money going out to brunch with friends. Many people waste money buying products that will ultimately find their way to a garage sale. It’s better to spend your money on things that will boost your happiness, like working on a hobby or doing activities with friends.

Here are a few budgeting tips to help you cut your expenses:

- Carpooling: This is a good way to reduce your gas expenses, and it also reduces wear and tear on your vehicle—which leads to expensive maintenance.

- Shop with a Grocery List: This will keep you from buying any food items you don’t need.

- Cut Streaming: There are dozens of different streaming services available. Most of them only cost around $7, but that adds up quite a bit when you’re paying for multiple accounts. Choose only one or two streaming services, or cut them altogether.

2. Earn More Than Your Base Income

If you have a higher debt-to-income ratio, a new budget will only get you so far. You can only cut your expenses so much before you run out of budget space. If that’s the case, you might need to find a way to earn more money than what you’re currently making.

There are a few different ways you can try and boost your income. First, you can change your tax withholding at work. When you claim tax allowance, the money that would typically make up your tax refund is distributed to all of your paychecks—so your paychecks are higher.

From an investment standpoint, it’s better to get higher paychecks and a lower tax refund—your tax refund is basically money that you’ve lent to the government, but they’re not even paying you interest for it. It is better to put that money back into your bank account, so you can use it to pay down your debt.

If you haven’t already, ask your employer for a new W-4 form and claim one more tax allowance than you currently have. [Be sure to read up on tax withholdings so you don’t claim too many allowances—too many allowances may result in a penalty.]

A more significant way to boost your income is to secure a pay raise. Unfortunately, many Americans choose not to seek a promotion because they don’t want extra responsibilities or because they like the work they’ve been doing. But if you’re saddled with debt, you should reconsider your employment position. Work harder to earn a promotion or seek new employment where you’ll be paid a higher salary.

Last but not least, you can earn supplemental income by getting a side gig. Here are a few great ways to make extra money:

- Drive Rideshare: If you have a vehicle that’s up-to-snuff, you can make money giving rides on Uber or Lyft. These apps can pay well for a minimum amount of work, and you also get to set your own hours.

- Vacation Rentals: If you own property, you already have one of the best ways to earn a supplemental income. Rent out your property to tenants or as a vacation rental. If you’re living in the property, you might consider moving out and living in an apartment. But if you don’t want to move out of your primary residence, you might also consider renting out an available room or guest house.

- DIY: Are you good at crafting things? You can make a good profit selling homemade products on Etsy. The internet makes it easy for you to sell any of your skills that are in demand.

- Side Job: Consider getting a weekend job that’ll provide some extra cash. You might consider finding a job that offers benefits, like health insurance (employers like Starbucks and Costco offer these kinds of perks). Benefits may help you cut your overall living expenses.

[Pro Tip: Looking for a new job? Always secure a new position before you leave your current position. You don’t want to be unemployed when you’re struggling with debt.]

3. Make Extra Payments

You’ll get out of debt faster if you pay more than your minimum payment amount. For example, if your monthly payment on a loan is $200, consider paying $250. The faster you pay off your debt, the more money you’ll save. In addition, fewer payments means less interest paid. Look over your budget and determine how much extra money you can contribute.

Don’t spread your extra contribution across several loans—focus on paying off one loan faster than the rest.

There are two strategies you can use: the debt avalanche method and the debt snowball method.

Debt Avalanche Method

With the debt avalanche method, you pay off the loan with the highest interest rate first.

Let’s say you have loans with interest rates of 5%, 3%, and 1.5%.

First, you would make extra contributions to the loan with 5% interest. When that’s paid off, you’d do the same for the 3% interest loan and then the 1.5% interest loan.

The debt avalanche method is optimal for people who have a lower DTI.

Debt Snowball Method

With the debt snowball method, you would make extra contributions to the loan with the lowest outstanding balance.

Let’s say you have loans with balances of $1,000, $3,000, and $15,000.

First, you would make extra contributions to pay off the $1,000 loan, followed by the $3,000 and the $15,000.

The debt snowball method is optimal for people with a higher DTI.

[Pro Tip: Commit any windfalls to your debt, like a tax refund, bonus, or stimulus check. Commit between 50% – 100% of your windfall, if possible.]

4. Refinance Your Debt

Refinancing your debt can save you hundreds of dollars in interest. This is a particularly helpful way to get out of student loan debt or mortgage debt.

You probably won’t be able to refinance credit card debt (unless you do a balance transfer—more on that later), but you can refinance your mortgage, auto loan, and student loans.

5. Negotiate a Settlement

If you have a very high DTI and there are few ways for you to handle your debt without going bankrupt, then you should consider calling your creditors and negotiating a debt settlement.

Under a debt settlement, a credit card company may eliminate a substantial amount of your credit card debt—at the expense of your credit score. But you can always work to rebuild your credit score over time. You don’t want to file bankruptcy—or worse, lose your home because you can’t pay your mortgage or rent.

You might be wondering why credit card companies would ever agree to a debt settlement. If you go through bankruptcy, the company is less likely to collect as much money from you. It’s better for them to collect some money from you than none at all, especially if you don’t have many valuable assets that can be repossessed.

Debt settlement is a last-resort measure, but it can be a life saver.

Tools to Get Out of Debt

There are a few additional tools available for your get-out-of-debt toolbox. These tools won’t single-handedly get you out of debt, but they’re extraordinarily beneficial when paired with any of the five strategies we’ve discussed.

Balance Transfers

A balance transfer is an effective way to “refinance” your credit card debt.

Many credit card companies allow you to transfer debt from an existing credit card to a new credit card with a 0% interest rate—the 0% interest rate will last for a predetermined amount of time. Enough time, hopefully, for you to pay down your credit card debt without being burdened by interest payments.

There are some risks with this approach:

- Sometimes there’s a fee to transfer the balance

- You’re going to receive new credit—which may provide further temptation to spend money with it

- You need to be able to make large enough payments to pay down most, if not all, of your debt before the 0% interest expires

- You’ll still need adequate credit to open a new card—and many companies will deny you if your existing credit card balances are too high

Overall, this may be an effective tool for people who have a lower DTI.

Consolidation Loans

A consolidation loan may be one of the most effective tools to get out of debt. A consolidation loan will pay off all your outstanding debt, which in turn will eliminate the accompanying interest. Then, the only debt you’ll have will be the consolidation loan itself.

Consolidation loans are helpful because they can drastically reduce the interest that you’re paying toward your debt. It’s also easier to focus on paying off a single loan instead of several different loans.

A few things to be mindful of:

- Consolidation loans tend to be very large, so you must be prepared to handle the monthly payment and interest

- Consolidation loans are usually up to $100,000, so you may not be able to use it to pay off your mortgage

- When you pay off your credit card debt, you need to be disciplined and prevent yourself from maxing out the cards again

You still need to have good credit to take out a consolidation loan. However, consolidation loans are usually easier to qualify for than a new credit card.

Cash Advance Apps

Cash advance apps give you an advance on your upcoming paycheck. They’re similar to a payday loan service, but they have lower interest rates.

With most cash advance apps, you can pay back your balance once you receive your actual paycheck, or the balance will be automatically taken out of your next direct deposit.

Cash advance apps are helpful for people who have a high DTI, who are living paycheck to paycheck and are having difficulty paying their bills on time.

Credit Counseling & Debt Management

Credit counseling or debt management services may be helpful if you’re struggling to get out of debt on your own.

Exercise caution—there are lots of scams in this marketplace. Avoid any service that promises it will reduce the amount of debt you owe (these are the equivalent of a get-rich-quick scheme). Also, avoid companies that charge you too much money, making your financial situation more difficult.

The National Foundation for Credit Counseling will direct you to a local nonprofit service with a good reputation.

Summary

Five strategies can help you get out of debt: 1) 50/30/20 budget 2) Earn more than your base income 3) Make extra payments 4) Refinance your debt 5) Negotiate a settlement. Furthermore, you can work toward eliminating your debt by using balance transfers, consolidation loans, cash advance apps, and debt counseling services. You can use your debt-to-income ratio (DTI) to figure out which strategy is right for you.

Paul Esajian, is the co-founder of FortuneBuilders, CT Homes, LLC, and Equity Street Capital and one of the nation’s premier real estate investors and educators, and author of this article.